The hidden power of an ESG approach to sector investing

Compartir

Adding an ESG filter to a sector ETF could help investors mitigate risk and may increase returns – while improving ESG and carbon intensity scores.

Investment sectors are a way to group together companies according to their line of business, and many investors use sector-based funds to manage risk and diversify equity portfolios. But by delving deeper into sectors, you can access a powerful investment tool.

While a sector-based approach can help investors to adjust portfolio positioning according to their macro-economic views, investment objectives and risk tolerance, ESG sector ETFs allow you to use these powerful, flexible and cost-effective tools to potentially generate some compelling ESG improvements too.

What are sectors?

• A coherent ‘mini universe’ portfolio of stocks operating in the same business field

• Stocks in a sector are likely to share similar performance patterns, reflecting similar exposure to macro-economic cycles

• In-built diversification – sector investment might considerably reduce specific risk (i.e. the risk coming from company specific factors within the portfolio) compared to holding a single stock

• Low correlation between returns from different sectors, reflecting positioning on the economic value chain and exposure to different business activities

• Looking at Sector performance since 20111, when it comes to sector allocation in an equity exposure, making the distinction between cyclical and defensive sectors can prove a useful instrument:

• Cyclical sectors (e.g. Consumer Discretionary, Materials) tend to outperform during periods of economic expansion & financial stability

• Defensive sectors (e.g. Consumer Staples, Healthcare) tend to outperform during periods of economic contraction & financial volatility

Navigating economic cycles

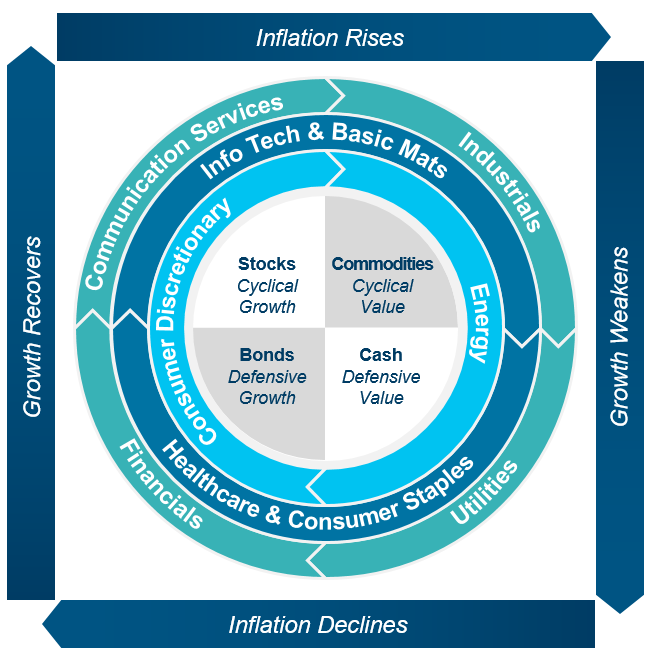

We can illustrate sectors’ broad exposure to the economic cycle using the fundamental metrics of economic growth and inflation (see graphic below).

By anticipating the evolution of the economic cycle, investors taking a sector-based approach can adjust their portfolio weightings with a view to capturing valuation shifts between sectors.

Source: Amundi, July 2023

Adjusting risk exposure

Investors have long implemented the 60/40 portfolio, which has 60% in equities and 40% in bonds. The approach is designed to benefit from the upside potential of stock markets, while protecting from some of the downside risk with diversification in bonds.

Things didn’t go to plan for 60/40 investors in 2022. As equities slid, bonds slipped right alongside them. While the model didn’t work well in 2022, it has nevertheless consistently generated attractive risk-adjusted returns over the last few decades. So there really isn’t a strong case for junking a model that’s been largely successful over many years before. So how could it be improved?

Taking a more active approach with equity sector exposures could be an answer. This would enable a portfolio to maintain its 60% weighting in equities, but use sector ETFs to overweight sectors that are more likely to show resilience, and underweight areas liable to underperformance at a given point in the economic cycle. A flexible sector allocation strategy, implemented using sector ETFs, could help cushion the falls during market downturns.

ESG benefits with little compromise

Whether your decisions are driven by fundamentals, macroeconomics or momentum-based approaches, sector ETFs are flexible, cost-effective portfolio building blocks that can rapidly set your investment strategy to work.

Adding ESG to the sector approach could have further advantages over non-ESG. Taking global equities as an example, our research shows that adopting an ESG sector approach rather than using conventional global sectors delivers a 10% improvement in ESG score2 and a -30% reduction in carbon intensity3. And we have found that these benefits don’t come with radical changes to portfolio characteristics.

Sticking with the example of global equities, our research shows that, compared to their parent sector index, ESG sector indices offer:

1. Very similar beta

The difference in beta of an ESG sector compared to its parent index is negligible (close to 0%) while the performance differential between an ESG and non ESG sector allocation is also limited).

2. High levels of diversification

ESG sectors hold on average 108 stocks – 23% fewer than MSCI World sectors1, for example. Despite this reduction, ESG sectors still offer attractive levels of diversification compared to holding small numbers of individual stocks.

3. Contained tracking error

Overall, the 1-year tracking error averages 2.8%, ranging from a high of 6.3% in Energy unexpectedly to a low of Financials, Healthcare and Consumer Discretionary (1.5%, 1.2% and 1.4% respectively)1.

4. High correlation of returns

The risk-return profile of an ESG sector allocation is very similar to a non ESG one. On average, the correlation of returns between ESG sectors and their respective parent index is 99%1.

A viable way to manage risk and increase portfolio diversification

ESG sectors have very similar characteristics to their parent sectors but bring significant ESG and carbon intensity benefits.

From time to time, there might be differences in the returns of a conventional sector-based approach compared to an ESG sector-based strategy, but in our opinion, these divergences are relatively small given the added ESG benefits.

In our view, ESG sectors represent a way to manage risk and increase portfolio diversification. By switching from a conventional to an ESG sector approach, investors can preserve their portfolios’ risk/return characteristics while making a significant improvement on both their carbon footprint and ESG score. It also remains well aligned when it comes to diversification and representativeness.

1. Source Bloomberg, Amundi. Data as at 31/10/2022. Past performance is not indicative of future performance.

2. Source: Bloomberg, Amundi 31/05/2023

3. Source: Bloomberg, Amundi 31/05/2023, Scope 1 +Scope 2 / EVIC

KNOWING YOUR RISK

It is important for potential investors to evaluate the risks described below and in the fund’s Key Investor Information Document (“KIID”) and prospectus available on our websites www.amundietf.com.

CAPITAL AT RISK - ETFs are tracking instruments. Their risk profile is similar to a direct investment in the underlying index. Investors’ capital is fully at risk and investors may not get back the amount originally invested.

UNDERLYING RISK - The underlying index of an ETF may be complex and volatile. For example, ETFs exposed to Emerging Markets carry a greater risk of potential loss than investment in Developed Markets as they are exposed to a wide range of unpredictable Emerging Market risks.

REPLICATION RISK - The fund’s objectives might not be reached due to unexpected events on the underlying markets which will impact the index calculation and the efficient fund replication.

COUNTERPARTY RISK - Investors are exposed to risks resulting from the use of an OTC swap (over-the-counter) or securities lending with the respective counterparty(-ies). Counterparty(-ies) are credit institution(s) whose name(s) can be found on the fund’s website amundietf.com or lyxoretf.com. In line with the UCITS guidelines, the exposure to the counterparty cannot exceed 10% of the total assets of the fund.

CURRENCY RISK – An ETF may be exposed to currency risk if the ETF is denominated in a currency different to that of the underlying index securities it is tracking. This means that exchange rate fluctuations could have a negative or positive effect on returns.

LIQUIDITY RISK – There is a risk associated with the markets to which the ETF is exposed. The price and the value of investments are linked to the liquidity risk of the underlying index components. Investments can go up or down. In addition, on the secondary market liquidity is provided by registered market makers on the respective stock exchange where the ETF is listed. On exchange, liquidity may be limited as a result of a suspension in the underlying market represented by the underlying index tracked by the ETF; a failure in the systems of one of the relevant stock exchanges, or other market-maker systems; or an abnormal trading situation or event.

VOLATILITY RISK – The ETF is exposed to changes in the volatility patterns of the underlying index relevant markets. The ETF value can change rapidly and unpredictably, and potentially move in a large magnitude, up or down.

CONCENTRATION RISK – Thematic ETFs select stocks or bonds for their portfolio from the original benchmark index. Where selection rules are extensive, it can lead to a more concentrated portfolio where risk is spread over fewer stocks than the original benchmark.